If you are considering a career in finance, becoming a financial analyst can be a highly rewarding path. Financial analysts play key roles in shaping investment strategies, managing portfolios and guiding businesses in financial planning. They work with data, market trends and financial models to help organizations and clients make informed decisions on where and how to invest.

In Canada, financial analysts can benefit from various certifications, such as Chartered Financial Analyst and Certified Financial Planner, to enhance their qualifications and expertise.

What Does a Financial Analyst Do?

Financial analysts are responsible for collecting and analyzing financial data to provide advice on investments, financing and other financial matters for their company or clients. Their work can involve evaluating areas such as takeover bids, private placements, mergers or acquisitions. Financial analysts are employed by a variety of organizations in both the public and private sectors, including banks, brokerage houses, insurance companies, investment firms, manufacturing companies, utility companies and underwriting firms.

In their daily duties, financial analysts evaluate financial risks, prepare forecasts and write reports and recommendations related to capital management. They also plan both short-term and long-term cash flows, assess financial performance, and evaluate investment projects. Financial analysts may advise on and participate in the financial aspects of contracts and tenders, follow up on financing projects with financial backers, and develop tools for managing and evaluating financial records. They also prepare regular risk profiles for debt records and assist in preparing operating and investment budgets.

What is a Certified Financial Analyst?

A certified financial analyst is a generic or informal term used to describe financial analysts who have completed certifications or credentials in finance. A Chartered Financial Analyst or CFA is a formal designation awarded by the CFA Institute. The CFA designation is internationally recognized and highly respected in the finance industry, especially in investment management, portfolio management and financial analysis roles. Earning the CFA involves passing a series of three challenging exams, gaining professional experience, and adhering to a strict code of ethics.

There are other certifications that can be helpful depending on what areas a financial analyst would want to pursue. The Certified Financial Planner (CFP) designation, offered by FP Canada, is ideal for professionals focused on personal financial planning, covering topics like retirement, tax strategies, insurance, and estate planning. The Chartered Professional Accountant (CPA) designation is Canada’s primary accounting credential, essential for those seeking expertise in accounting, financial statements, and corporate finance. Other valuable certifications include the Financial Risk Manager (FRM) for risk analysis, the Canadian Securities Course (CSC) for foundational financial services knowledge, the Chartered Investment Manager (CIM) for investment management, and the Advanced Financial Modeler (AFM) for financial modeling skills. These certifications can help financial analysts specialize in fields such as investment management, financial planning, accounting or risk management.

Educational Requirements

Candidates typically need a bachelor’s degree in fields such as commerce, business administration or economics. Many entry-level positions are accessible with an undergraduate degree, though on-the-job training and industry-specific courses are often required to develop practical skills. Additionally, some employers prefer candidates with a Master of Business Administration (MBA) with a concentration in finance or a master’s degree in finance, which provides deeper knowledge and can open doors to more advanced roles. As mentioned above, the Chartered Financial Analyst, or CFA, designation is considered an asset in some areas and may be required by some employers.

Skills Required for Financial Analysts

Financial analysts rely on a mix of technical expertise and soft skills to excel in their field. Analytical skills are essential, allowing them to examine large data sets, identify trends and extract valuable insights for decision-making. Strong financial modeling abilities are also a must, enabling analysts to accurately forecast revenues, expenses and other key financial metrics. Mastery of tools such as Excel is often vital in this process.

Attention to detail is crucial, as even minor errors can significantly affect reports and lead to flawed data analysis while creating financial models. Clear communication skills are important, as analysts frequently need to present complex data in reports and presentations that are easily understood by stakeholders. Problem-solving skills also play a significant role, as analysts interpret data creatively to offer strategies that enhance financial health or investment outcomes.

Proficiency with financial software supports their data analysis, while a solid understanding of economic principles and market trends helps them provide accurate forecasts and recommendations.

Key responsibilities

The scope of financial analyst jobs is broad and includes tasks such as evaluating financial performance, developing investment strategies or portfolio management. They work in various settings, from small firms to large financial institutions and government agencies to small nonprofit organizations. Their insights are valuable for strategic planning and achieving financial stability for their clients or employers and risk assessment. Financial analysts may specialize in different areas, such as corporate finance and investment banking.

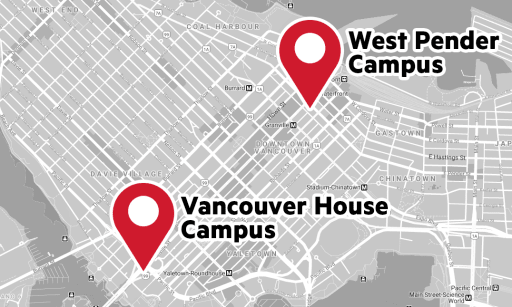

How UCW Helps You Become a Financial Analyst

University Canada West offers a Bachelor of Commerce and Master of Business Administration. Students benefit from practical training and access to resources that prepare them for career challenges. UCW’s programs are designed to help students build a strong base, setting them on the path to certification and career success.

Conclusion

Becoming a financial analyst requires dedication to education and skill-building. With a solid academic foundation and certifications, financial analysts can unlock a range of career opportunities in sectors from banking to corporate finance.

Frequently Asked Questions

How Much Does a Financial Analyst Earn?

The earnings of financial and investment analysts can vary depending on experience, location and the industry. According to WorkBC, the annual average salary in British Columbia for financial analysts is $78,898. Those with a certification often earn higher salaries, as the certification adds to their value in the industry.

Do I need a CFA to become a financial analyst?

While a CFA is not strictly required, it helps. Many junior analyst positions are accessible with a bachelor’s degree in finance, economics, accounting or a related field. However, earning a CFA designation can significantly enhance your qualifications and career prospects, especially for positions in investment management or senior roles within finance.

How long does it take to become a financial analyst?

Typically, completing a bachelor’s degree takes around four years, depending on the student’s pace and some positions require additional training or experience. For those pursuing a CFA designation, the certification process adds more time, as it involves three exam levels that often take several years to complete, depending on the candidate’s pace.

What skills are most important for a financial analyst role?

Key skills for most financial analysts include strong analytical abilities, proficiency with numbers and a good understanding of financial data. Skills in financial modeling, attention to detail and critical thinking are essential, as analysts interpret complex information to guide financial and investment decisions. Communication skills are also important since analysts often need to present their findings and recommendations clearly to colleagues or clients.

How competitive is the financial analyst job market?

According to the Canadian government’s Job Bank, the employment outlook for financial and investment analysts in British Columbia is expected to be moderate from 2023 to 2025. This outlook is influenced by factors such as a projected decline in employment, limited opportunities for retirement and a small pool of unemployed workers with recent experience in this field.

Approximately 5,800 individuals work as financial and investment analysts in British Columbia, primarily in sectors such as central banking, securities and related financial activities (57%) and in provincial public administration (6%). A majority of analysts (93%) work full-time, a higher proportion than the average for all occupations. Of those employed part-time, most worked an average of 48 weeks per year, compared to the 42-week average in other sectors.

Among financial and investment analysts, 82% work year-round, while 18% work only part of the year. Roughly 14% of these professionals are self-employed, slightly below the overall average. Education levels are high, with 52% holding a bachelor’s degree and 27% possessing a degree above the bachelor’s level.

Is a CFA designation worth it in Canada?

The CFA designation is highly regarded in Canada and can be a valuable credential for financial analysts looking to advance their careers. It’s especially worth it for those aiming for roles in investment analysis, portfolio management or financial advising, as it demonstrates expertise and commitment. While the CFA requires significant effort and investment, it often leads to better job opportunities and higher salaries in the Canadian finance sector.

RELATED BLOGS

Job roles and responsibilities for BCom with Accounting elective area graduates

BCom vs BBA: Which program should you take?

What can you do with a business degree: Career paths and opportunities