As small business owners in Canada retire, businesses worth a massive $1 trillion will be changing hands in the next ten years. However, it appears unlikely that these small businesses will be passed on to the next generation.

The Canadian Federation of Independent Business states that retiring baby boomers have no intentions of handing over their business to the next generation. This explains why employee ownership has become an integral part of succession planning in Canada.

Several CEOs and business owners are now turning toward this model as a way of recovering some equity at retirement and creating a well-oiled and close-knit group of employees who will have the expertise and knowledge to continue the business without the original owners.

Golder Associates’ former CEO Brian Conlin has just finished handing over the reins to a workforce of more than 9,000 employees. Conlin said that succession planning is a problem for all businesses regardless of their size. He pointed out that some of the biggest corporations in the world are family-owned and are facing the same problem.

Traditionally, businesses tend to be handed down to the next generation. However, the newer generation has different ideas altogether and does not necessarily always want to stay with the family business, said Conlin. He added that many owners building successful small and mid-sized businesses end up waiting until the last moment to tackle succession.

Businesses that depend on the knowledge, skills and intellect of employees are ideal for employee ownership. This form of ownership also plays a role in stemming employee turnover. However, as Conlin mentioned, small business owners should plan succession early because it can take time for employees to own a sufficient stake in the business.

Employee ownership has far-reaching benefits. Because their ownership is at stake, employees often go the extra mile to ensure customers are satisfied with the service provided. Employee-owned businesses often do better than traditional businesses as their employees are more productive.

Employee ownership is becoming popular in BC. Companies such as Hayes Elevator are encouraging employees to buy shares of the company using payroll deductions. Employees who quit or retire have the option of selling their shares whenever they want.

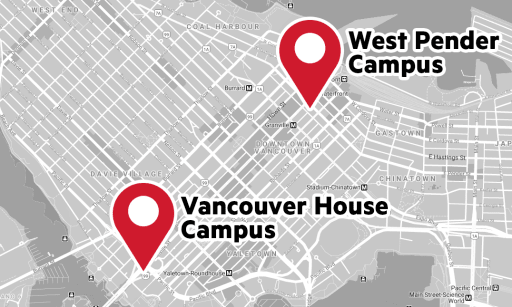

While succession planning is part and parcel of a successful business model, aspiring entrepreneurs should first learn the techniques of creating and building such a business model. One way to gain the knowledge needed is by acquiring a UCW MBA degree. The UCW MBA program is designed to create global business and thought leaders who drive their organization onto the path of success using their business acumen, critical thinking and analysis, and it gives them the ability to come up with innovative solutions to business challenges.