For small businesses, one of the biggest challenges they face is raising funds to help get them off the ground, establish themselves and grow, and it is one of the main reasons small businesses struggle to compete with globally. However, this situation is changing, particularly in Canada.

Recent data shows that small business owners in Canada are borrowing more. In November 2015, the Small Business Lending Index (SBLI), a measure of small business loan volumes over the previous 30 days based on data from credit analysis provider Paynet’s lenders, increased from 132.6 to 138.3. This rise is largely attributed to demand that came from the agriculture, construction and manufacturing sectors.

It is traditional for small businesses to go to local banks for financing, but this is no longer the only option. The federal government has introduced a small business financing program that aims to help entrepreneurs get their ventures going and established businesses make improvements and expand by providing loans that may not otherwise be available.

The program is open to startups and small businesses in Canada generating gross annual revenues of $10million or less, offering them loans of up to $1million each.

However, more and more small businesses are now getting financing more quickly and easily online than they can through traditional lenders.

“It has always been difficult for small businesses to find capital and raise money, even in good times,” Thinking Capital CEO Jeff Mittelman said. “With the technology available they can go online, provide their information and get an answer and financing within a day or two.”

Thinking Capital is an online company based in Montreal that provides Canadian owned companies that have been in business for at least six months and have average monthly sales of $7,000 or more with financing ranging from $5,000 to $300,000.

Many of Thinking Capital’s clients are small businesses such as dry cleaners, hair salons and restaurants that make up communities across the country, according to Mittelman. Clients can get expert advice and support from Thinking Capital at any time via telephone, email and online chat, as well get tips and access resources aimed at helping them grow, and secure additional financing.

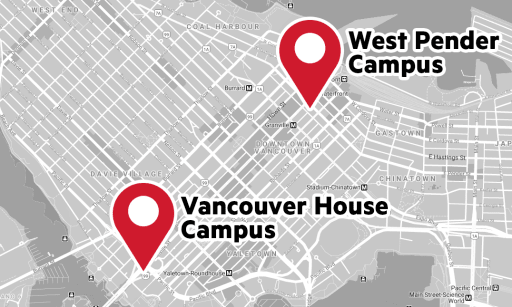

While small business owners in Canada can now take advantage of a range of financing options, aspiring entrepreneurs still need the right skills in order to manage their ventures successfully. By enrolling in the University Canada West (UCW) master of business administration (MBA) program, they will have access to education that will provide them with the efficiency and effectiveness needed to build accomplished careers.