Grow, a marketplace lender based in Vancouver, launched just over a year ago, and CEO Kevin Sandhu estimates that the company has already processed applications that amount close to $1 billion.

Mr. Sandhu said that his company witnessed a growth in the middle of 2015 after it branched out and started exploring partnerships. This gave Grow a lot of exposure and allowed it to acquire investors who back loans to borrowers; forge a partnership with First West Credit Union; and get an investment of $10 million from the founders of Peer 1 Hosting and PlentyOfFish.

Small business owners in Vancouver could benefit from marketplace or peer-to-peer lenders, who keep traditional banks out of the picture when it comes to loan processing. Instead, small businesses can use the marketplace lender’s digital platform to directly connect with investors. These loans are usually approved online, and the approval process takes about 24 hours.

Several traditional financial institutions, credit funds and institutional funds are supporting marketplace lending in Canada. A corporate securities lawyer revealed that these lenders were offering investors interest ranging from eight to 14 percent.

A majority of peer-to-peer lending platforms are registered as exempt market dealers in Canada. As a result, they are free to underwrite securities that are exempt from prospectuses. The lenders offer security in the form of a promissory note when investors lend funds to small business owners. This offers security to all parties involved in the transaction.

Sandhu believes that the marketplace lending industry will benefit from more stringent regulations, as lenders have a lot of sensitive information related to investors and borrowers. This information can easily be misused without proper laws in place. Until then, P2P lending is driving the success of small business owners.

Many small businesses find it difficult to meet the strict criteria of traditional lending institutions and are unable to get access to funds that can help them grow and expand. With P2P lending, small business owners can get access to quick funding options that can prove to be invaluable in today’s competitive business environment.

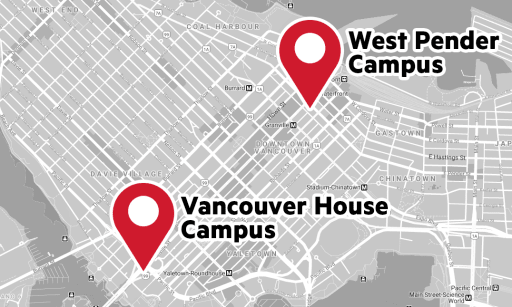

Students who are interested in entrepreneurship and small businesses will benefit from the UCW MBA program. The program is designed to develop MBA students into graduates who are effective and efficient leaders that use innovative and out-of-the-box solutions to resolve challenges in tough business situations. The graduates know how to make informed decisions to drive organizational success. The UCW MBA program uses classroom lectures and cases studies to prepare graduates for real-life business challenges and experiences.