People are now spending more time than ever on various social media platforms connecting with other users and possibly marketing and promoting their services and products. While these platforms are an excellent source of acquiring new customers, they also contain valuable information about their users. This is why alternative lenders are now checking prospective borrowers’ social media footprints to determine their creditworthiness.

In the past, a lender looked at a borrower’s credit score to decide whether it was safe to extend them a loan. However, now this is changing. Alternative lenders and online fintech companies are using social media to track prospective borrowers’ habits.

Steven Uster is the founder and CEO of FundThrough, which offers small business owners advances on supplier invoice amounts. He states that everything a person does on the internet is tracked. He claims that a person who spends a lot of time on social media platforms has a different credit report compared to a person who does not spend time on these platforms.

Uster states that alternative lenders look to determine how responsive small business owners are to their customers and the time when the loan application was filed. If an application is filed late at night, it could be a sign that the small business owner is desperate for money.

Lenders also look at the speed at which the application was filed, the shipping history of the organization, and the economic profile of the neighbourhood where the small business operates. It goes without saying that receiving five-star reviews on authority review sites such as Yelp and TripAdvisor are an advantage, but having thousands of connections on LinkedIn and Facebook could be a sign that the borrower spends more time on social media and less time focusing on their business.

Depending on the type of loan an individual wants, fintech firms are checking either the individual’s personal social media page or the business page. Analyzing the profile allows the company to determine whether the data provided by the prospective borrower is authentic. It also allows alternative lenders weed out possible fraud and help self-employed individuals get the credit that they would otherwise be denied by traditional lending institutions.

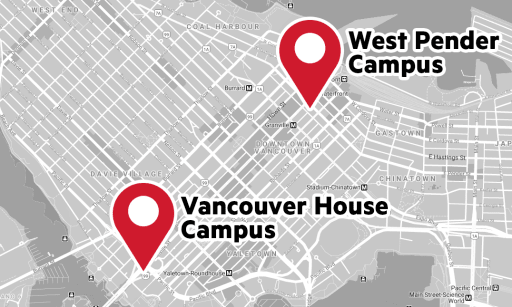

The CEO of Progressa, a personal lending firm in Vancouver, BC, says that fintech firms have learned from the 2008 financial crash when due diligence was ignored by lenders. Ali Pourdad says that firms are now scrutinizing applicants using algorithms to analyze big data and creating modern credit profiles. Pourdad says that his company conducts a close and detailed analysis of prospective borrowers’ financial situations before extending credit.

There is no doubt that alternative lenders have made it easy for small business owners to get credit that traditional lenders may deny. However, prudent financial management is the key to creating a creditworthy online profile. Small business owners can benefit from a UCW MBA degree. The UCW MBA program’s Tier 2 Management Principles and Practices courses focus on Managerial Accounting and Financial Management. These courses allow prospective small business owners and entrepreneurs to gain financial acumen to drive business success without undermining their business’ financial security.