The trend of investing in socially-responsible projects and businesses is believed to have been inspired in part by the values of millennial investors, and Canadian fintech companies are now looking to target this demographic, with several launching products and services designed to appeal to ethical sensibilities.

Three months ago, online investment adviser WealthSimple unveiled a socially responsible portfolio, and around 10 percent of the company’s clients have now signed up for it, according to WealthSimple Founder and CEO Michael Katchen.

“It has been hugely popular,” he said. “Our clients love it.”

Socially responsible investing, also known as ethical investing, looks to align personal ethics with finance, and its popularity has grown over the last few years, driven by the principles of millennials looking to invest.

A report published last year by the Responsible Investment Association said that, as of December 31st 2013, more than $1trillion of Canadian assets were being managed using at least one responsible investing strategy, up from $600billion in 2011.

“Socially responsible portfolios really try and avoid investing in companies that do not have a good environmental, social or corporate governance record,” ModernAdvisor Portfolio Manager and Chief Compliance Officer Isaac Schweigert explained.

ModernAdvisor, an online financial advisor, is based in Vancouver, British Columbia, and the city is showing the way when it comes to ethical and socially-responsible investing, and social causes in general, according to Schweigert, and ModernAdvisor is looking to be at the vanguard of the investment side of things.

Online small business lender Merchant Advance Capital launched an ‘impact loan’ earlier this month, which offers reduced rates to entrepreneurs looking to invest in socially-responsible endeavours that will have a positive effect on their community or the environment.

Merchant Advance Capital Founder and CEO David Gens, a millennial himself, said that, while the company will lose some profitability as a result of the program, he started it because he wanted to do something that would benefit the world.

“The primary aim of the product is to encourage businesses to make investments that will have a positive benefit in their community,” said Gens. “That is priority number one.”

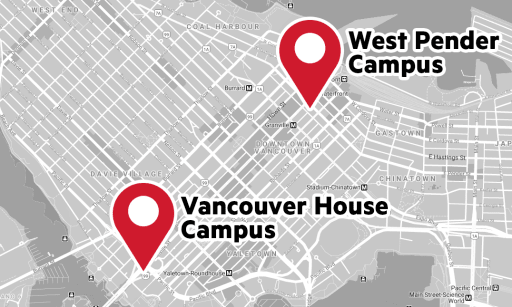

Socially-responsible entrepreneurs will be able to make more informed business decisions with a University Canada West (UCW) master of business administration (MBA) degree. The UCW MBA program gives students access to education that will enable them to weigh up the implications of business activities, boosting graduate employability and creating successful careers in Canada and beyond.