An economic downturn doesn’t necessarily spell doom for a business. Instead, it could help highlight cracks in a business plan and help you build a better one. Business strategies during a recession need to be backed by analysis, experience and solid judgement.

An economic recession is a challenging time for business and consumer confidence. A survey from Pollara Strategic Insights found that Canadians’ 2024 financial outlook was among the most pessimistic it had recorded in 29 years, with 82% of Canadians believing Canada is in a recession. The poll found Canadians don’t expect 2024 to be any better, with 53% expecting Canada’s economy to worsen and only 15% expecting it to get better.

Defining an economic recession

A recession is a period when growth slows down significantly. This is often seen when the country’s Gross Domestic Product, or GDP, decreases for two consecutive quarters. Other signs of a recession include a higher unemployment rate, less consumer spending and reduced industrial production. These indicators show that the economy is shrinking rather than growing.

Recessions can happen due to various reasons, such as sudden increases in prices, financial crises or unexpected events such as wars or pandemics that can impact the global economy. For example, if oil prices suddenly rise, it can make other goods more expensive, leading people and businesses to spend less. This reduced spending can cause businesses to cut back, leading to job losses, which then further decreases spending and deepens the recession.

The effects of a recession are widespread and can last for a long time. Governments and central banks often try to counter a recession by lowering interest rates or increasing public spending to boost the economy. However, these measures don’t always work quickly and the economy might take a while to recover. The social impacts, like increased poverty and inequality, can linger even after economic growth improves.

How to survive a recession

Navigating a recession can be challenging, but with the right approach, a business can not only survive but potentially emerge stronger. The following strategies could help a business endure tough economic times and even capitalize on opportunities that arise.

Know where the business stands

Recessions impact every business differently. It is essential to know the break-even point – where total revenue equals total expenses. Analyzing the books will help determine whether increasing revenues or lowering costs is necessary.

Improve cash flow

Cutting any expenses that do not contribute to profitability is crucial. Lowering fixed expenses should be prioritized. This could be done by negotiating with suppliers for lower costs in exchange for longer-term contracts to reduce inventory expenses.

Focus on marketing

Marketing during a recession can be tricky because many consumers are trying to spend less. Offering discounts or allowing customers to pay by installments can be effective if feasible. Advertising and social media should reflect empathy, togetherness and empowerment, recognizing that people are going through tough times. Emphasizing the value and quality of the product or service can remind loyal customers why they chose the company in the first place.

Avoid slashing salaries

Cutting pay to save money risks demoralizing employees. Instead, eliminating unnecessary overtime or controlling costs may be a better option.

Diversify revenue streams

Exploring new products, services or markets can reduce dependence on a single source of income. By offering a broader range of options, a business can attract new customers and create additional revenue streams that help stabilize the company during uncertain times.

Strengthen relationships with customers

During tough times, loyal customers are invaluable. Strengthening relationships with them through excellent customer service, personalized deals, or regular communication can keep them engaged. Happy customers are more likely to remain loyal during a recession.

Invest in employee training

Rather than cutting costs by reducing staff, investing in employees can be more beneficial. Providing additional training can help employees acquire new skills, making the workforce more versatile and the business more resilient. Skilled employees can also make it easier for the company to pivot if market conditions change.

Monitor economic indicators

Staying informed by closely monitoring economic indicators relevant to the industry is vital. Understanding trends allows for anticipating changes and adjusting strategies accordingly. Being proactive rather than reactive can make a significant difference in weathering economic challenges.

Conclusion

Running a small business during a recession is challenging. But a recession doesn’t have to spell the end. Coming up with a strong, well-executed plan and staying focused can help a company come out stronger on the other side of an economic downturn.

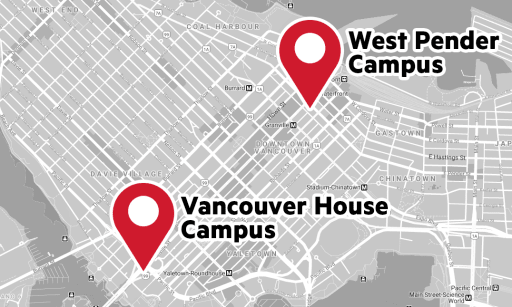

Courses at University Canada West give you the knowledge and practical tools to make well-informed business decisions on this and other business topics.

Frequently Asked Questions

What not to do during a recession?

Making knee-jerk decisions out of fear or panic should be avoided. Cutting too much too quickly in areas like marketing, research and development, or employee training can harm a business in the long run. These areas drive future growth, and while cutting them may save money in the short term, it can leave the business vulnerable when the economy improves. Additionally, taking on high-interest debt to cover short-term gaps can create more significant problems down the line. Instead, it is better to make strategic adjustments that keep the business sustainable without sacrificing future growth.

What stops a recession?

Recessions typically end when economic growth improves, often triggered by a combination of government policies such as lowering interest rates, increasing public spending or implementing tax cuts. These measures can stimulate consumer spending and business investment, leading to job creation and increased economic activity. Technological advancements, innovation or improvements in global trade can also contribute to recovery. Ultimately, restoring confidence in the market is essential, as it encourages businesses and consumers to spend and invest again, leading to economic recovery.

What good things happen during a recession?

Although recessions are challenging, they can also bring about positive changes. Businesses are often forced to become more efficient, eliminating unnecessary costs and finding ways to maintain profitability. This focus on efficiency can lead to long-term improvements in business operations. Recessions can also create opportunities to acquire assets or talent at a lower cost. New businesses or startups may emerge, filling gaps in the market left by weaker companies. For consumers, recessions can result in lower prices on goods and services as companies compete for sales.

How to prepare for economic collapse?

Preparing for an economic collapse involves building resilience both financially and personally. This includes establishing an emergency fund that can cover at least six months of living expenses. Diversifying investments to reduce risk is crucial, with consideration given to holding assets in stable, non-correlated forms such as precious metals or real estate. Reducing debt is also essential; paying off high-interest loans and avoiding new debt can provide financial stability. On a personal level, developing skills that remain in demand regardless of economic conditions and cultivating a network of contacts can offer support and opportunities during tough times.

Related Blogs

Top 10 business and technology trends of 2024

Five ways to help small businesses survive the pandemic

How businesses can navigate inflation