Inflation, the rise in the prices of goods and services over time, can be a significant challenge for businesses. It erodes the purchasing power of money and can eat into a company’s profits if not managed effectively.

To protect their profits from inflation, businesses must adopt an initiative-taking approach that involves a combination of strategies and prudent financial management.

What is inflation?

Inflation is the sustained increase in the general price level of goods and services in an economy over a period of time. It indicates a decrease in the purchasing power of a nation’s currency, as each unit of currency buys fewer goods and services.

What is causing inflation?

Inflation can be caused by a variety of factors, some of which include an increase in the money supply, higher production costs, growing consumer demand and supply chain disruptions. Government policies, such as excessive fiscal stimulus or loose monetary policies, can also contribute to inflationary pressures.

Additionally, external factors like changes in global commodity prices and geopolitical events can impact inflation rates. Understanding the complex interplay of these factors is essential for policymakers and economists to effectively manage and control inflation.

According to the Bank of Canada, the current rise in inflation around the world is a combination of a spike in commodity prices, a surge in the global demand for goods and impaired supply chains. At the onset of the COVID-19 pandemic, prices of commodities like oil, natural gas and lumber drastically dropped as the economy shut down, leading to a sudden shift in consumer demand from services to goods. However, the pandemic-induced disruptions in global supply chains, including factories and ports, hindered the supply from meeting the increased demand. Consequently, prices soared as economies reopened. The situation was further exacerbated by Russia’s invasion of Ukraine, causing global supply issues and rising food costs as both countries combined count for one-third of all global wheat exports.

How is inflation measured?

In Canada, the primary measure of inflation is the Consumer Price Index or CPI, which is calculated and published monthly by Statistics Canada. The CPI tracks the changes in the price of a basket of goods and services commonly purchased by Canadian households. The CPI covers a wide range of consumer goods and services, including food, shelter, transportation, household operations, clothing and recreation, among others. The Bank of Canada and policymakers use the CPI as a key indicator to monitor and assess the rate of inflation in the country and to make informed decisions about monetary policy and economic management.

How can businesses protect their profits from inflation?

While some companies can benefit from inflation, others may face challenges such as increased operating costs, reduced consumer purchasing power and supply chain disruptions. Companies need to carefully manage their operations and financial strategies to navigate the complex challenges presented by high inflation.

Pricing strategies: One of the most direct ways businesses can counteract the effects of inflation is through strategic pricing. Companies need to adjust their pricing strategies to accommodate increased costs. This can involve passing some of the inflationary pressures onto customers through price increases. However, it’s crucial to strike a balance to avoid alienating customers or losing market share. Careful market research and competitor analysis can help determine the optimal pricing strategy.

Cost control: To protect profits, businesses must exercise strict control over their costs. This includes scrutinizing all expenses and finding ways to reduce waste and inefficiency. Streamlining operations, renegotiating supplier contracts and implementing cost-saving technologies are all effective measures. Businesses should also consider energy-saving initiatives and sustainability practices to reduce utility costs in the long run.

Efficient supply chain management: Inflation can disrupt supply chains by increasing the cost of raw materials and transportation. Businesses should diversify their supplier base and explore alternative sourcing options to mitigate these risks. Negotiating long-term contracts with suppliers and adopting just-in-time inventory practices can also help stabilize costs.

Hedging strategies: Hedging involves using financial instruments to protect against price fluctuations. Companies can use commodities, futures contracts or currency hedging to manage their exposure to volatile input costs or exchange rate fluctuations. While hedging carries its own risks and costs, it can provide a degree of certainty in an uncertain economic environment.

Inventory management: Effective inventory management is crucial during inflationary periods. Keeping excessive inventory on hand can lead to increased storage costs and potential losses if prices drop. On the other hand, having too little inventory can result in production delays and missed sales opportunities. Businesses should adopt a data-driven approach to inventory management, using historical sales data and demand forecasts to optimize inventory levels.

Product innovation: Inflationary pressures can also be an opportunity for businesses to innovate. By developing new products or services that are more efficient or cost-effective, companies can maintain or even expand their profit margins. Innovation can also open up new markets and revenue streams, reducing dependence on existing products or markets vulnerable to inflation.

Negotiate long-term contracts: Entering into long-term contracts with customers, suppliers and even employees can be one strategy in how to beat inflation. Fixed-price contracts can help businesses lock in prices for essential inputs or secure revenue streams at predetermined rates, reducing exposure to inflation.

Strategic debt management: Taking on debt can be a useful tool for financing growth or smoothing out cash flow, but it should be done judiciously. In times of inflation, businesses should be cautious about variable-rate loans, as rising interest rates can increase debt servicing costs. Consider refinancing existing debt with fixed-rate loans to protect against interest rate fluctuations.

Monitor and adapt: The economic landscape is constantly changing and inflation rates can vary over time. Businesses must continuously monitor market conditions, economic indicators and their own financial performance. Regularly reassessing and adjusting strategies in response to changing circumstances is essential to profit protection.

Employee compensation: Inflation can affect employee morale and retention if wages don’t keep pace with rising living costs. To maintain a motivated and stable workforce, businesses should consider periodic salary adjustments, performance-based bonuses and non-monetary incentives like flexible work arrangements.

Cash flow management: Effective cash flow management is crucial during inflationary periods. Businesses should strive to accelerate the collection of accounts receivable and extend the payment of accounts payable to maximize cash on hand. Implementing efficient invoicing and payment systems can help streamline cash flow.

What to invest in during inflation?

Excess cash reserves can lose value over time due to inflation. Businesses should consider prudent investment strategies that offer higher returns than the inflation rate. This may involve investing in a diversified portfolio of assets or exploring alternative investments that provide a hedge against inflation, such as real estate or commodities.

Businesses face the ongoing challenge of protecting their profits from inflation. While inflation is a macroeconomic phenomenon that is beyond their control, businesses can adopt various strategies to mitigate its impact. While there are some companies that profit from inflation, most will need a combination of pricing adjustments, cost control, supply chain management, financial hedging and innovation. This can help companies navigate inflationary periods successfully. It’s essential for businesses to remain vigilant, adaptable and forward-thinking to safeguard their profitability in the face of economic uncertainty. By implementing these strategies, businesses can not only protect their profits but also position themselves to thrive in a dynamic and ever-changing market environment.

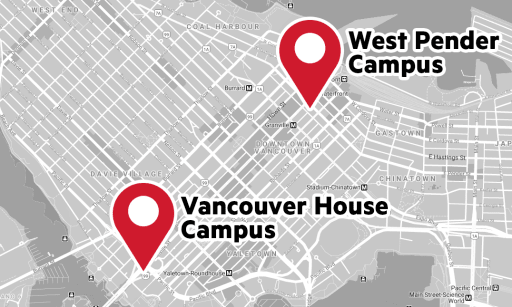

Learn about inflation at UCW

Learn more about inflation and global economics through University Canada West’s esteemed MBA program. Gain practical insights through case studies and projects, and learn to apply theoretical knowledge to real-world scenarios, including those affected by inflation. Additionally, networking opportunities and interactions with industry professionals can offer valuable perspectives on how businesses and organizations respond to and navigate through inflationary environments.

Published on October 27, 2023.