By Brendan Clugston, December 13, 2024

Becoming a financial planner is a great career for those who love helping people manage their money and achieve their financial goals. It’s a role that combines financial knowledge with people skills. Whether it’s investments, retirement planning or debt management, financial planners are the guide to a secure financial future for their clients.

Financial planning is the process of creating a comprehensive financial plan that helps individuals, families and businesses achieve their financial goals. It involves an assessment of a client’s entire financial picture, including their income, expenses, assets, debts and objectives. Financial planners use this detailed information to develop a plan that addresses their clients’ needs.

Financial planning involves creating comprehensive strategies that help individuals, families and businesses achieve their financial goals. It requires a detailed assessment of a client’s income, expenses, assets, debts and objectives to develop tailored plans. Key components of financial planning include:

- Investment Planning: Growing wealth through strategic investments.

- Retirement Planning: Ensuring financial security during retirement.

- Estate Planning: Managing the transfer of assets after death.

- Tax Planning: Minimizing tax liabilities and maximizing savings.

- Risk Management: Protecting against financial loss through insurance and other tools.

By addressing these aspects, financial planning serves as a roadmap for achieving financial stability and security. Financial planners offer expert advice and support throughout this process.

What is a Certified Financial Planner?

In Canada, being a Certified Financial Planner, or CFP, is one of the most notable designations in the industry. The Canadian Securities Institute provides educational pathways tailored to different sectors of the financial industry, helping professionals meet the educational requirements set by FP Canada to obtain the designation. The CFP certification is recognized as the “gold standard” in financial planning, essential for marketing financial planning services and often required by employers, especially for roles involving high-net-worth clients. It’s worth the effort if you want to make a difference in people’s lives.

What do Financial Planners do?

Financial planners help individuals and families navigate personal finance challenges by creating tailored financial plans. They:

- Conduct a comprehensive review of clients’ financial situations, including income, expenses, savings, investments and debts.

- Identify and prioritize short- and long-term goals, such as saving for a home, funding education, preparing for retirement or managing debt.

- Develop strategies that include budgeting, investment planning, tax efficiency, retirement planning and risk management.

- Provide ongoing support, adjusting plans as clients’ lives evolve.

- Educate clients on complex financial concepts to ensure informed decision-making.

Through their guidance, financial planners help clients remain confident and disciplined in pursuing their financial objectives, even during life changes or unexpected challenges.

Steps to Becoming a Certified Financial Planner in Canada

Education Requirements

The first step to becoming a CFP is to complete a post-secondary education, with finance, accounting and business studies as a good foundation. Courses in economics, statistics and financial management are helpful. UCW’s Bachelor of Commerce (BCom) is a good starting point.

Completing the CFP Certification Program

The next step is to enrol in a CFP certification program. This program covers financial planning principles, investment management, tax strategies and estate planning. Educational courses related to mutual funds are integral to the certification process, especially for those focusing on the mutual fund industry. The coursework will give you the theoretical knowledge to serve your clients.

Writing the CFP Exam

After the coursework, candidates must write the CFP exam. This tough test will test their ability to apply financial planning in real-life scenarios. The exam requires study and is a key part of the certification process.

Gaining Practical Experience

Practical experience is required for CFP certification. Candidates need to complete a certain number of hours in financial planning or a related field. This hands-on experience will give them the skills to deal with complex financial situations.

Maintaining CFP Certification

After certified, financial planners must follow professional and ethical guidelines. They must also complete continuing education credits to stay current and maintain certification.

Essential Skills for Certified Financial Planners

Successful financial planners possess strong analytical skills to interpret financial data and identify optimal strategies. Communication is key as they must explain complex concepts in a way clients can easily understand. Empathy and interpersonal skills help planners build trust and long-lasting relationships with clients. Additionally, problem-solving abilities and attention to detail are crucial for creating effective financial plans.

Career Opportunities for CFP Professionals

CFP professionals can work in various settings, including financial institutions, private firms and as independent advisors. Roles may include investment advisors, wealth managers or retirement planning specialists. Experienced financial planners may choose to specialize in wealth management, assisting clients with their overall financial health and strategic planning as they navigate complex financial situations. Many CFPs also specialize in areas like tax planning or estate management. With the growing demand for financial expertise, career prospects in this field remain strong.

It’s a career that offers numerous benefits, making it an attractive option for those interested in finance and helping others. Here are some of the key advantages:

- High Demand: Financial planners are in high demand, and the field is expected to continue growing in the coming years. As more people seek professional advice to manage their finances, the need for skilled financial planners will only increase.

- Flexibility: Financial planners can work in a variety of settings, including banks, investment firms, insurance companies and private practices. This flexibility allows professionals to choose the work environment that best suits their preferences and career goals.

- Variety: Financial planners work with a diverse range of clients, each with their own unique financial needs and goals. This variety keeps the job interesting and challenging, as planners must tailor their advice and strategies to meet each client’s specific situation.

- Personal Satisfaction: Financial planners have the opportunity to make a positive impact on their clients’ lives. By helping clients achieve financial stability and security, planners can experience a great sense of personal satisfaction and fulfillment.

- Good Compensation: Financial planners are generally well-compensated, with median salaries ranging from $60,000 to over $100,000, depending on experience and location. Top earners in the field can make significantly more, especially those who build a strong client base or specialize in high-demand areas.

- Opportunities for Advancement: Experienced financial planners can move into leadership roles, such as managing a team of advisors or overseeing a financial planning department. Alternatively, they can start their own practices, offering the potential for greater autonomy and income.

- Professional Development: The financial planning field is constantly evolving, with new regulations, products and strategies emerging regularly. Financial planners must stay up-to-date with the latest developments and trends, providing opportunities for ongoing learning and professional growth.

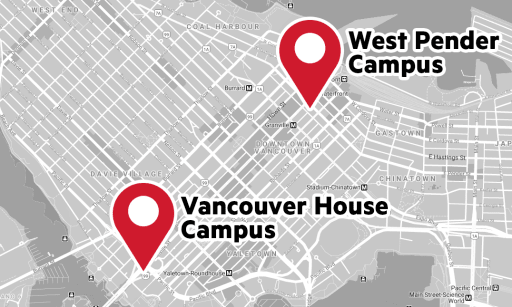

How UCW Helps You Become a CFP

University Canada West has programs that prepare students for a career in financial planning through business and finance courses. UCW also connects students with industry professionals through networking and mentorship programs.

Conclusion

Being a financial planner is a great career that combines technical skills with a passion for helping others. By getting the CFP designation you can build a career guiding clients to their financial goals. With hard work and the right education like UCW’s programs, you can succeed in this field.

Frequently Asked Questions

What is the difference between CFP and QAFP certification?

The CFP certification is more advanced, requiring a higher level of education and experience than the Qualified Associate Financial Planner, or QAFP, designation. CFP professionals handle complex financial planning, while QAFP holders focus on simpler financial needs.

How long does it take to become a financial planner in Canada?

It typically takes three to five years to meet all the education, experience and certification requirements for becoming a CFP. The timeline may vary depending on prior education and work experience.

What are the average salaries for financial planners in Canada?

The salary for financial planners in Canada ranges from $23.08 to $70.51 an hour, with a median of $35.71, according to the Government of Canada’s Job Bank. Experience, location and specialization can impact salary, while top earners in the field can make significantly more.

Can I become a financial planner without a degree?

Having a degree is usually required to become a financial planner in Canada, but requirements vary from province to province. You can learn more about the requirements under the Government of Canada’s Job Bank.

Who can provide financial advice?

In Canada, only qualified professionals like CFPs, QAFPs or licensed financial advisors can provide financial advice. Always ensure your advisor has the proper credentials to offer reliable guidance.

RELATED BLOGS

Job roles and responsibilities for BCom with Accounting elective area graduates

BCom vs BBA: Which program should you take?

What can you do with a business degree: Career paths and opportunities