By Brendan Clugston, October 11, 2024

A Bachelor of Commerce (BCom) is one of the most versatile degrees in the business world. Combined with an accounting elective area, BCom graduates are not just bookkeepers; they are financial problem-solvers who help organizations maintain their financial health.

The job market for professionals continues to grow as businesses rely on accurate financial data for decision-making. Whether working in a corporate environment, a public accounting firm or as independent consultants, BCom grads enjoy a wide range of career opportunities. From entry-level roles to senior management positions, the possibilities are endless for those who hold a BCom.

Top job roles for BCom graduates

A BCom opens doors to many career paths in the financial world. Graduates have a solid understanding of financial principles, accounting practices and business management, making them highly valuable in many industries.

Accounting skills are consistently in demand. The accounting elective area, in combination with the rest of the BCom degree, will prepare you for entry into a professional accounting program.

It’s important to note that accounting is an elective area. While it is a great way to prepare students and shape a degree, there are further steps to take in order to receive a professional designation. To become an accountant in British Columbia, you need to complete a bachelor’s degree in accounting or a related field, enrol in the Chartered Professional Accountants (CPA) Professional Education Program and pass the Common Final Examination (CFE). Additionally, you must gain 30 months of practical work experience under the supervision of a CPA mentor. Once all educational, experience and ethical requirements are met, you can apply for your CPA designation and begin your accounting career.

Let’s take a closer look at some of the top job roles available for BCom graduates who go on to earn their CPA.

Accountant

Accountants handle a company’s financial records, ensuring everything is accurate and up-to-date. They prepare financial reports, balance sheets and income statements, which help companies track their financial performance. Accountants also make sure businesses comply with tax regulations and help prepare tax returns. This role involves working with various types of financial data, and many accountants specialize in areas like public accounting, government accounting or forensic accounting.

Auditor

Auditors play a key role in ensuring a company’s financial practices are transparent and in line with legal regulations. They review financial statements and records to identify inconsistencies or potential issues. Internal auditors work within companies to assess risk management and internal control processes, while external auditors are hired to examine a business’s financial statements for accuracy. BCom graduates who enjoy problem-solving and have a keen eye for detail often thrive in this role, crucial for maintaining trust in financial markets.

Financial analyst

Financial analysts assess financial data and provide insights that help companies make informed business decisions. These professionals often work for investment firms, banks or large corporations. They evaluate economic trends, analyze financial reports and recommend actions like investing in stocks or bonds. Financial analysts use data to forecast future financial performance and help companies optimize their strategies.

Tax consultant

Tax consultants, also known as tax advisors, specialize in tax law and help individuals and businesses prepare for tax season. They offer advice on minimizing tax liabilities, complying with tax regulations and taking advantage of deductions. Staying up-to-date with changing tax laws is key to offering accurate advice. This role requires analytical skills. Tax consultants are highly sought after by both individuals and corporations.

Management Accounting

Management accountants, also called cost accountants, work closely with business managers to assist in financial planning and decision-making. They focus on budgeting, forecasting and analyzing financial performance to help managers make sound financial decisions. Management accountants work with various departments to ensure a company’s financial health. A BCom with an accounting elective area equips graduates with skills in budgeting, financial analysis and business management.

Financial planner

Financial planners help individuals and businesses create long-term strategies for managing their finances. This includes retirement planning, investments and estate planning. Financial planners work closely with clients to understand their goals and offer advice to help them reach those goals. BCom graduates have a strong foundation in financial principles, which is crucial for guiding clients through complex financial decisions. Financial planners need strong interpersonal skills to build trust with their clients. Note that in British Columbia, financial planners must be certified and registered under regulatory frameworks. Additionally, financial planners may need to be registered with the BC Financial Services Authority, depending on their activities.

Responsibilities common across accounting roles

Many tasks overlap across different accounting roles. Some common responsibilities shared by accountants, auditors, financial analysts and other professionals in the field include:

- Financial reporting: Preparing and analyzing financial statements, including balance sheets and income statements, is a central task in most accounting roles.

- Budgeting and forecasting: Accounting professionals often help with budgeting and financial forecasting, analyzing past performance to predict future trends.

- Compliance with laws and regulations: Ensuring businesses comply with tax laws and financial regulations is vital. Failure to comply can lead to significant penalties.

- Internal controls and risk management: Auditors and management accountants assess and improve internal controls and risk management to protect against fraud and financial loss.

- Data analysis and interpretation: Financial analysts and planners analyze financial data to identify trends, opportunities and risks.

Career pathways and opportunities for growth

A BCom with an accounting elective area offers numerous opportunities for advancement. Many graduates start in entry-level positions, such as junior accountants or audit assistants. After gaining experience, they can pursue the CPA certification.

As accounting professionals gain more experience, they may move into senior roles like financial manager or CFO. Specialized fields like forensic accounting or international taxation provide further opportunities. With the rise of technology, accounting professionals skilled in data analytics are also highly sought after.

Conclusion

A BCom with an accounting elective area provides a strong foundation for a wide range of careers in finance and business. Whether as accountants, financial analysts or tax consultants, graduates can look forward to a stable career with ample opportunities for growth. The skills and knowledge gained through this degree prepare graduates to handle the complexities of modern financial systems and help organizations maintain their financial health. With the right skills and experience, BCom graduates can build successful, rewarding careers in various industries.

Frequently Asked Questions?

Is BCom a good career?

Yes, a BCom with an accounting elective area can set graduates up for strong career choices in Canada. It offers graduates a solid foundation in financial principles, opening doors to various opportunities in industries like banking, corporate finance and auditing. Accounting professionals are in demand across sectors, and the stability and potential for growth make it a reliable career path. With additional qualifications, like the Chartered Professional Accountant designation, BCom graduates can enhance their career prospects and earning potential.

Which industries hire the most BCom graduates?

BCom graduates are employed across many industries in Canada. Common sectors include financial services, public accounting firms, government and corporations in various fields like retail, manufacturing, healthcare and real estate. Additionally, many graduates find roles in auditing, taxation and consulting, particularly in public accounting firms.

Is BCom with an accounting elective area difficult?

The difficulty of a BCom with an accounting elective area depends on the individual’s aptitude for numbers and attention to detail. While accounting requires a strong understanding of financial concepts, problem-solving and analytical skills, students with a genuine interest in the field usually find it manageable. The workload can be demanding, particularly in upper-year courses like financial reporting, taxation and auditing, but with dedication and the right study habits, it can be successfully completed.

Which course is best for accounting?

In Canada, many universities offer strong accounting programs within their BCom degrees, but courses that prepare students for the Chartered Professional Accountant designation are particularly valuable.

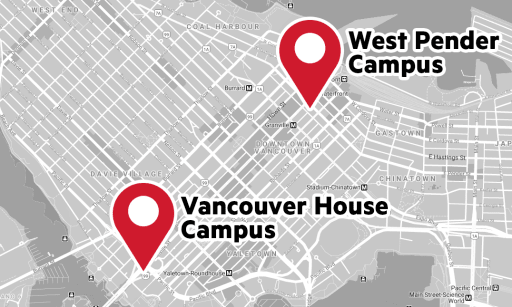

University Canada West, through its Bachelor of Commerce program, has an articulation agreement with the Chartered Professional Accountants of British Columbia, so students can transfer credit courses for 100% of the CPA Professional Education Program. Students who are missing one or more of the required courses for direct admission into the Chartered Professional Accountants Professional Education Program can complete the equivalent coursework at University Canada West.

A list of specific CPA prerequisite requirements that University Canada West students may be exempt from taking if they have the completed courses at UCW can be found here.

Courses in financial accounting, managerial accounting, taxation and business law are also essential for a career in accounting.

What qualification is best for accounting?

The best qualification for accounting in Canada is the Chartered Professional Accountant (CPA) designation. This is a widely recognized and respected certification that opens up career advancement opportunities in various sectors. To become a CPA, individuals must complete the CPA Professional Education Program (PEP), gain relevant work experience and pass the Common Final Examination (CFE). The CPA designation is considered the gold standard for accounting professionals in Canada.

Related blogs

What can you do with a business degree: Career paths and opportunities