Navigating the world of a university often feels like a tightrope walk between gaining independence and managing financial responsibilities. With the rising costs of tuition, books, housing and everyday life, the need for smart financial decisions is paramount, causing many students to wonder how to save money in Canada.

Saving money as an international student in Canada can be particularly important given the potential financial constraints and the cost of tuition and living expenses.

The first step to any financial plan is understanding where your money comes from and where it goes. Before you can begin saving, it’s crucial to have a clear picture of your expenses. If you aren’t great at juggling numbers, apps can be incredibly useful.

There are numerous things that can be done day-to-day to reduce spending, however, a good place to start your planning is with a monthly budget.

Create a detailed monthly budget that outlines your income and expenses so you can track your spending and identify areas to cut costs. By categorizing and monitoring your expenses, you gain insights into your spending habits, enabling you to set limits for both essential and non-essential expenses.

The dilemma of books and supplies

Textbooks are notoriously expensive, but there are ways around the hefty price tags. Rather than buying new, consider exploring online marketplaces or university bulletin boards for second-hand options. Additionally, many universities have libraries where textbooks are available for student use. If you prefer a digital touch, e-books or online resources can sometimes be more affordable. And remember, at the end of the term, selling the books you no longer need can recoup some of your initial costs.

UCW even has Open Education Resources (OER) that include textbooks, journals and more. The online resources, most commonly textbooks, are free and online for students and instructors to use, removing the financial barrier.

Unlocking the power of student discounts

Being a student isn’t just about late-night study sessions; it’s also about enjoying the perks that come with a student ID card. From restaurants to retailers, many establishments offer discounts to those with a valid student ID. Additionally, joining student associations or clubs can come with the bonus of exclusive deals through partnerships with local businesses.

Rethinking your food habits

One of the significant expenses for university students is food. While eating out or ordering takeout might be tempting, the costs add up quickly. Cooking at home becomes not only a money-saving endeavour, but also a life skill. Embracing batch cooking, where you prepare several meals at once and freeze portions for later, can be both economical and convenient. Collaborating with friends or roommates for potluck dinners can also spread out the cost and effort of meal preparation. With a little planning, even grocery shopping can become a money-saving activity. Buying non-perishable items in bulk or using coupons can lead to significant savings over time. Opting for supermarkets or local markets over convenience stores can also ensure better deals.

Transportation

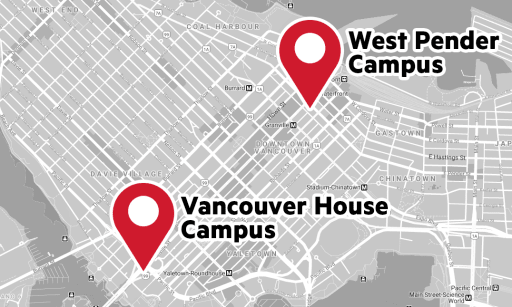

Depending on where you’re studying, owning a car might seem like a necessity. However, the costs of maintenance, insurance and fuel can strain a student’s budget. Public transportation can be an affordable alternative. Many campuses are also pedestrian-friendly, making walking or cycling viable options.

How to save money daily

Managing finances as an international student can be challenging, but there are several tips to save money in Canada you can follow to make the most of your resources.

Share expenses: Consider sharing living expenses with roommates to reduce rent and utility costs. Shared accommodations are often more affordable.

Shop smart: Look for sales, discounts and use coupons when shopping for essentials. Compare prices at different stores. Consider buying generic or store-brand products to save on groceries and toiletries. Explore thrift stores and online marketplaces for second-hand clothing, furniture and household items. This can save you a significant amount of money.

Banking: Choose a bank or credit union with low or no monthly fees for international students. Look for a student account that offers benefits like free transactions and online banking. Being mindful of where you withdraw money by only using your bank’s machines can also save you from pesky ATM charges.

Part-time work: While academics should be a priority, many students find that part-time employment becomes essential to cover their expenses if their study permit allows it. Leveraging personal skills such as writing, graphic design or tutoring can provide flexible freelance opportunities. Be mindful of any restrictions on your study permit regarding work hours.

Communications: Consider using prepaid mobile plans or discount phone carriers to save on phone bills. Take advantage of free Wi-Fi on campus or in public places.

Avoid credit card debt: While credit cards offer a sense of financial freedom, they can also be a pitfall if not used responsibly. It’s easy to accumulate debt with just a few thoughtless swipes. Being diligent about paying off the full balance every month can save you from spiralling interest rates.

Plan travel wisely: If you plan to travel within Canada or abroad, book tickets and accommodations well in advance to take advantage of lower prices. Consider group travel for additional savings.

Financial literacy: Invest time in learning about personal finance and budgeting. Understanding how money works will help you make informed decisions and save more effectively.

Seek scholarships and grants: Explore scholarship and award opportunities for international students. These financial awards can help offset tuition and living expenses.

The university phase of life, while filled with its financial challenges, also offers numerous opportunities for smart savings. By being proactive, making informed decisions and occasionally thinking outside the box, students can enjoy their university years without the constant weight of financial stress.

Published on November 10, 2023.