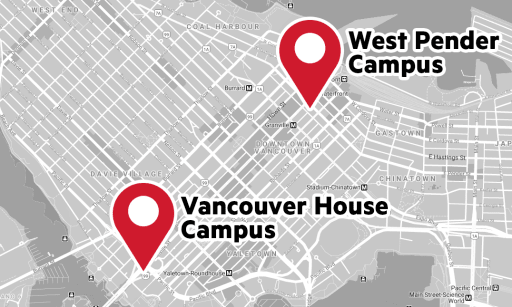

The Bachelor of Commerce (BCom) will provide you with a broad foundation knowledge of contemporary business and its practices. Based in Vancouver, Canada, this ACBSP-accredited degree prepares you for a successful career in business or management, where you will contribute constructively to a global economy.

UCW’s BCom program has also received the NCMA designation from CIM | Chartered Managers Canada.

Students currently enrolled in the BCom program are entitled to a free Associate Membership with the association, giving UCW students the chance to belong to Canada’s chartered management and leadership association while earning their degree.

Associate Members can participate in all the networking and professional development opportunities the association offers, helping them get ready for their new career after they graduate.

Graduates of the BCom program will be able to:

- Use managerial and financial tools to assess basic business issues critically.

- Research and analyze business systems, processes and functions in the context of local, regional and global conditions.

- Apply contemporary business methods to problems and contexts.

- Create ethically and legally sound proposals, plans and projects.

- Organize information to communicate persuasively to target audiences.

- Demonstrate critical thinking and reflection skills in course deliverables.

- Work productively in a collaborative and multicultural environment.

Elective Areas

UCW follows professional trends in industry closely and develops elective areas that reflect the best professional standards in specific fields. Currently, we offer the following elective area in the BCom degree:

Accounting

Accounting skills are consistently in demand. The accounting elective area, in combination with the rest of the BCom degree, will prepare you for entry into a professional accounting program.

Course Coverage for CPA Programs

Thanks to an articulation agreement between UCW and the Chartered Professional Accountants (CPA) of British Columbia, students can transfer credit courses for direct entry into the CPA Professional Education Program (PEP). This means your career is accelerated by taking the required CPA PEP prerequisite courses while getting your degree, instead of waiting until after you have your Bachelor of Commerce.

Students who are missing one or more of the required courses for direct admission into the Chartered Professional Accountants Professional Education Program (CPA PEP) can complete the equivalent coursework at University Canada West.

A list of specific CPA prerequisite requirements that University Canada West students may be exempt from taking if they have the completed courses at UCW can be found here.

Course Structure

The Bachelor of Commerce (BCom) provides you with a broad foundation of contemporary business knowledge and practices. Its courses are designed to provide a breadth of business perspective and skills, building your core skills in writing, research, and team performance.

Elective Areas

The University follows professional trends in industry closely and develops elective areas that reflect the best professional standards in specific fields. Although students cannot earn a formal credential by completing an elective area, it can be a great way to shape their degree. Currently, UCW offers the following elective area in the BCom degree:

Learning Methods

The BCom follows a course framework of four tiers, allowing you to progress efficiently. Team activities are an intrinsic part of many courses and build skills vital for professional success. You will learn through a combination of the following methods:

- Lectures and class discussions

- Studying academic literature

- Looking closely at case studies

- Team activities

Academic Standing

Students must remain in Good Academic Standing to continue their studies at UCW. To remain in Good Academic Standing, undergraduate students must maintain a 2.00 Cumulative Grade Point Average (CGPA). For full details about Academic Standing, refer to the current Academic Calendar here.

Entry Requirements

- Canadian High School (Grade 12) diploma or equivalent with an overall average of C or better (2.0 on a 4.33 scale)

AND

- Academic IELTS – 6.5 or better with a minimum of 6.0 in the writing band, or equivalent (for students whose first language is not English). More information is available in the English Proficiency section of this website.

You can complete the English pathway courses (University Access Program) in order to meet the English proficiency requirements of the Bachelor of Commerce program.

Provincial Attestation Letter (PAL)

A Provincial Attestation Letter (PAL) is required for prospective undergraduate students studying at UCW. To learn more, visit the PAL page on our website.

On-Campus BCom Tuition Fees

2024 Fees |

Domestic* |

International |

| Number of courses | 40 | 40 |

| Cost per course | $967** | $2,018** |

| Total Tuition Fees | $38,680 | $80,720 |

2025 Fees |

Domestic* |

International |

| Number of courses | 40 | 40 |

| Cost per course | $1,015** | $2,119** |

| Total Tuition Fees | $40,600 | $84,760 |

2026 Fees |

Domestic* |

International |

| Number of courses | 40 | 40 |

| Cost per course | $1,066** | $2,225** |

| Total Tuition Fees | $42,640 | $89,000 |

Tuition deposit for international students: $7,900

First term tuition deposit for domestic students: $500

*30% discount applies for Canadian Forces members and veterans on all programs.

**Additional costs related to textbooks and materials for each course are not included in tuition.

Graduation Requirements

UCW students must fulfil the requirements listed in the Academic Calendar in order to be eligible to graduate. For full details about Graduation Eligibility, refer to the current Academic Calendar here.